State of the US and Global VC Funding: Q2 2023 and Onward

- Go Global World

- Sep 14, 2023

- 6 min read

Updated: Sep 23, 2023

As 2022 brought the venture world to its knees, the second half of 2023 finally carries hope and promise. We’re not out of the woods yet, but you can see the summit. Is that so? Let's examine data from multiple sources, and everyone can draw their own conclusions.

Since last year’s downward spiral, we thought we’d never catch a break, seeing VC funding in Q1 of 2023 plunge once again. Fast forward to the present day, analysts say there’s now a glimmer of hope as the venture market finds its floor in Q2 of 2023.

Read on to find out the current trends in venture funding and see where we’re headed in the second half of 2023.

Venture capital raised

Having a much more focused and narrower data set than others, Carta was the only one that noticed an uptick in funding for the second quarter of 2023. According to their data, startups raised more than $15.4 billion in Q2. That’s 26% up from their previous Q1 report.

Carta’s report is based on their own US customer data gathered from more than 38,000 venture-backed companies and 2,200,000 security holders who manage over $2.9 trillion in equity.

Looking at broader data collected across the whole US region, Ernst & Young indicates VC-backed companies raised $29.4 billion in Q2, a 34% plunge from Q1.

CB Insights saw US funding fall by 27% quarter over quarter with $31.3 billion raised in Q2.

Pitchbook reported $39.8 billion (48% down from the start of 2022) raised in Q2 2023 through VC funding in the US. However, they did point out that early-stage startups were leveling to the same amount raised as they did in 2020 (a good sign).

Crunchbase’s report expanded the scope to North America, labeling Q2 the worst quarter in over three years. They reported North American startups raising $31.8 billion in seed through growth-stage rounds. For late and technology growth-stage funding, Crunchbase noted a 48% drop quarter over quarter.

Of course, we are still miles away from the good old days of 2021. And even Carta reports a 58% decline year over year. However, on a smaller scale, we do notice signs of the market finally stabilizing and all we need is that spark to warm it up a nudge.

Deals are flat, and average investment up

According to Carta’s data, deal volume in Q2 matched the numbers in Q1. The increased funding amount therefore implies an uptick in the average investment size. Carta reports it growing from $10.4 million to $13.1 million.

With a broader data set, Crunchbase also shows a relative flatline for overall deal volume: with a slight 7% change quarter over quarter. CB Insights recorded US deal activity falling by 13% from 2,667 to 2,320. The same goes for Pitchbook as they noted a slight shift in deal count for the US from 3,503 rounds in Q1 to 3,011 rounds in Q2.

VC funding by stage

According to Ernst & Young’s report for the US, half of the VC funds in the second quarter of 2023 were distributed in seed and Series A rounds.

Crunchbase noticed that early-stage investment in Q2 equaled the same indicator for the first quarter amounting to $13.5 billion (with just a slight 2% difference). That being said, there were quite a handful of rounds (22) in the $100 million + range.

Crunchbase data showed that seed and angel funding declined in the second quarter and turned out to be the poorest in years.

Carta claims Series A startups had better luck, raising $3.8 billion overall, a match for the same figures in Q1 of 2023. Carta’s narrow and focused customer data also showed prominent surges for later-stage companies:

42% rise for Series B

14% rise for Series C

A fervent 250% rise for Series D

Over 100% rise at Series E and beyond.

Obviously, Carta’s reports contradict Crunchbase’s analysis of its expanded dataset that we mentioned earlier (48% decline for late-stage startups). It’s hard to say who’s data is more telling of what’s to come in H2 of 2023. We’ll have to wait and see.

Valuations rise quarter over quarter

Carta gives optimistic numbers here as well. Here’s what happened to median valuations in Q2 of 2023 (compared to Q1):

5% rise at seed stage

2% rise at Series A

23% increase at Series B

35% leap at Series C

Fallback by 10% at Series D

Surge by 48% at Series E and beyond.

Pitchbook offered its dire discourse comparing the same figures year over year:

Median early-stage valuations fell by 20%

Median valuations for venture-growth startups dropped a whopping 62%.

The deathly grasp of down rounds

After a record-breaking surge from 15% to 20% in Q1 of 2023, down rounds in the second quarter were still holding tight, making up nearly 19% of all VC deals (according to Carta).

Founders who managed to crank their value up in the early stages should be wary and prepared to tighten their belts. Conserving resources and stretching the runway should be a top priority. Delivering on promises has never been more deciding.

Mega rounds on the rise

On a positive note, Ernst & Young reported that mega-round deal volume has finally curved upward from 50 to 60 (Q1 to Q2 2023) after its never-ending plunge at the end of 2021.

That being said, the total capital raised through mega rounds fell from $26 billion in Q1 of 2023 to $11.5 billion in Q2.

Unicorns flaunting about

Unicorn births ticked up according to CB Insights. Globally, there were 18 unicorn startups in Q2 of 2023, rising 20% from a 6-year low in the first quarter. The US hosted half of these rare occurrences. Be that as it may, 18 unicorns is still a gigantic drop of 80% year over year.

Venture activity by region

According to Carta, In the United States, the West (having fallen by 6.9%) still remains the king of all regions on the venture market with 44.3% of all investments made.

The Northeast is a solid second holding 29.9% of the market (rising from 26.8%). And the bronze goes to … The South with 20.1% (climbing from 18.1%). The Midwest is trailing long behind the pack with just 5.7% of deals made.

Zooming in, Ernst & Young reports the San Francisco Bay Area as the current undisputed champ with $9.1 billion capital raised and 31% of investments made. New York City placed second with $4.9 billion and 17%. Boston rounds up the leaderboard with $4 billion.

The second quarter of 2023 graced Washington, DC with three mega-rounds and $1.3 billion in funds raised overall. Los Angeles VCs contributed $1 billion to startups and the region also conjured two mega deals.

Despite being the underdog, Austin’s venture activity is on the rise. Driven by FinTech entrepreneurship, the region has totaled $1 billion in funding.

Trending industries and sectors

Nobody needs to name the elephant in the room here which is AI and generative tech (GPT). Crunchbase reported $25 billion contributed to AI startups in the first half of 2023. According to their data, that’s nearly a fifth of global VC funds raised.

OpenAI’s ChatGPT launch back in November 2022 provoked the AI craze which juiced up the venture market and is probably one of the reasons 2023 is steadily becoming a venture snowbreak. Starting off with the $10 billion funding of OpenAI by Microsoft in January.

So far we’ve seen billion-dollar rounds and acquisitions of AI companies such as Inflection AI and MosaicML (both deals are $1.3 billion). It’s becoming quite a crowded market with many other names such as Cohere, Builder.ai, and Runway having large capital infusions.

Aside from the obvious (Skynet emerging), Ernst & Young named information technology, healthcare, and business & financial sectors as booming in Q2 of 2023. Software startups, as always, are ahead of the pack.

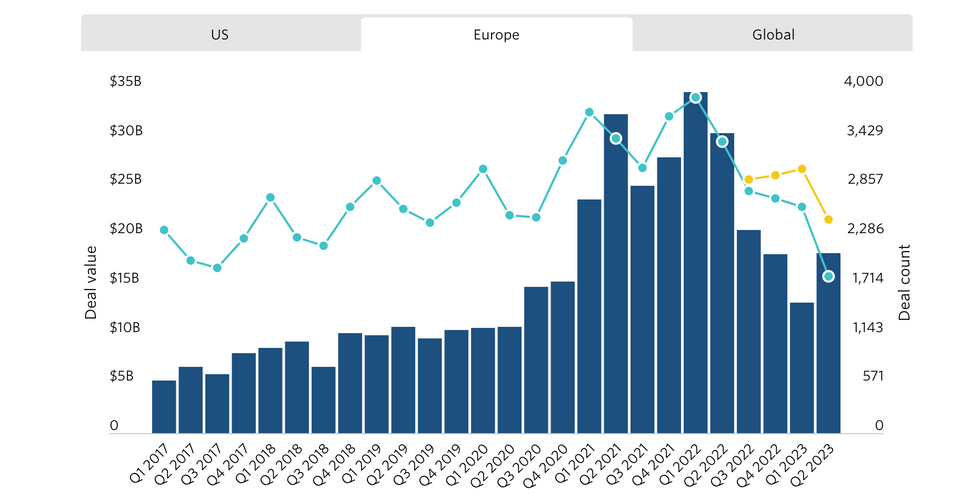

The global venture landscape

Here are a few insights into the state of the venture market on a global scale:

According to CB Insights, global venture funding dropped 13% quarter over quarter totaling $60.5B in Q2.

Crunchbase’s data shows similar figures, recording $144 billion raised in H1 of 2023, down 51% year over year. However, on a smaller scale, H1 of 2023 is only down 10% from the second half of 2022. So there are some signs of nearing equilibrium.

Zooming into each stage of startup evolution, global funding toppled on all fronts, from seed to growth-stage rounds.

On the bright side, CB Insights spotted a 17% uptick in public offerings quarter over quarter in H1, marking an awakening of the global IPO market. Plus, PwC has a highly positive outlook on the M&A market in H2 of 2023.

Conclusion

Unfortunately, we still haven’t escaped the downward trend of 2022 with VC funding collapsing year over year. However, on a smaller scale, there are signs of early spring for the US and global venture market.

Quarter over quarter we can see that we are slowing down in our descent. This trend is likely to continue in H2 of 2023 as the VC landscape approaches a plateau. Let’s hope this rollercoaster ride will see us ascending to a record-breaking market high soon enough.

Comments